A LITTLE ABOUT US

Keith E. Tatlock, CERTIFIED FINANCIAL PLANNER®

Command Wealth Management’s business philosophy is based on honesty, transparency, trust and loyalty. We expect our team to earn your confidence through collaborative and personalized financial planning, empowering you to make informed decisions based on your unique situation.

What can Command Wealth Management help you with?

Our Philosophy

Command Wealth Management (CWM) is an independent financial services firm dedicated to creating better financial lives for our clients in the accumulation and distribution phases. CWM leverages technology to provide clients with efficient, prompt, and high-quality service regardless of geographic location.

Our Financial Services

Retirement Planning

Retirement Planning

Retirement planning means preparing today for your future life so that you continue to meet all your goals and dreams independently. This includes setting your retirement goals, estimating the amount of money you will need, and investing to grow your retirement savings.

Portfolio Review & Evaluation

Portfolio Review & Evaluation

Portfolio review & evaluation refers to the evaluation of the performance of the investment portfolio. It is essentially the process of comparing the return earned on a portfolio with the return earned on one or more other portfolios or on a benchmark portfolio.

Cash Flow Analysis

Cash Flow Analysis

Engaging in ongoing cash flow analysis is important because it helps you to identify any problems with your incoming or outgoing cash. For example, if you have revenue streams that are not producing as much money as they should, cash flow analysis will shine a light on them so you can make changes.

Budgeting & Debt Management

Budgeting & Debt Management

Debt management is a way to get your debt under control through financial planning and budgeting. The goal of a debt management plan is to use these strategies to help you lower your current debt and move toward eliminating it.

Insurance Policy Review

Insurance Policy Review

An insurance review is a thorough look at your insurance coverage – the policies protecting your vehicles, home, family members, and other valuables.

Education Funding

Education Funding

Education funding advice is focused on helping borrowers plan and save for college expenses, and deal strategically with their private and federal student loan debt, including choosing the best repayment option, assessing loan forgiveness options, and assessing ways to minimize interest.

Estate Analysis

Estate Analysis

Behavioral Coaching & Wealth Mentoring

Behavioral Coaching & Wealth Mentoring

PROUD TO SERVE OUR MILITARY MEMBERS

While we serve all individuals seeking financial advice, we cater specially to military members—active or reserve—veterans and federal employees in the accumulation and distribution phases of their lives.

Sign Up For Your FREE GUIDE

Get a complimentary “10 Steps to a Successful Retirement” guide from Command Wealth Management!

Blog

Financial Markets and the Economy: A Look Back at 2025

Tech Leadership Shapes Another Strong YearThe past year delivered a blend of solid economic growth, easing inflation, and strong market performance, even as news headlines suggested uncertainty. U.S. equities posted broad gains in 2025, with strength again...

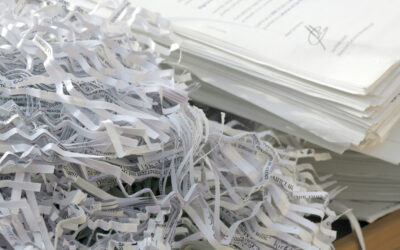

When Should I Shred it?

Understanding Document Retention PeriodsProper document retention is more than just a matter of decluttering—it's a critical component of financial management, legal compliance, and identity protection. Whether you're an individual taxpayer or a business owner,...

The US-China Trade War – Impacts on Global Markets and Futures

IntroductionOver the past several years, the US-China trade war has evolved from a policy dispute into a significant economic force with global implications. What started in 2018 as a modest tariff increase has now escalated into a full-blown trade conflict that...